My Role / Research and Visual Design

Tools / Adobe XD, Illustrator, Photoshop

Timeline / Research - 3 Weeks, Design - 1 Weeks

This was a 4-week client-focused project created within a senior user experience design course based on a brief from Barclays and the D&AD New Blood Awards. My specific roles included leading product strategy, research, conducting user interviews, storyboarding, visual design, and A/B testing.

View Full Brief

Mental health issues affect 1 in 4 people. Money and mental health are often intricately linked. One problem can feed off the other, creating a vicious cycle of growing financial problems and worsening mental health that is hard to escape. Across the UK, more than 1.5 million people are experiencing both debt and mental health problems.

How can Barclays help vulnerable customers with mental health issues manage their money better?

Barclays acknowledges that they need to make financial management more accessible and intuitive for high functioning people who are vulnerable to mental stress and related triggers. However, “mental health” is a broad spectrum and, we felt that we needed to hone in on a specific mental health issue to cater our solution as best as possible. Considering this, we began to take a look at some of the gaps and potential opportunities.

After some deliberation with my team as well as conducting more research, we decided to explore anxiety as it was a recurring theme and it seemed linked with finances. Instead of looking at banking as a whole, we began shifting the project to look at a certain area of banking and consider the relationship between it and anxiety. This shift gave us clearer metrics to measure the success of our project, such as patron confidence, reduced anxiety, and increasing engagement with Barclays. With this in mind, we were able to reframe our project into which financial matters do banking patrons with existing anxiety issues struggle the most with, and what can Barclays do to alleviate these problems?

An informative onboarding guide that breaks down financial jargon and helps anxious customers get their finances started off on the right foot.

We utilized both online and in-person research to discover common patterns and first-hand accounts anxious bank patrons had regarding their finances. One significant takeaway was that financial decision making can be influenced by anxiety, lack of knowledge, and resource availability. Another was that anxiety can often be caused by long-term financial aspects, not day-to-day. Finally, people don't know where to look for help, and or are embarrassed to seek help regarding finances.

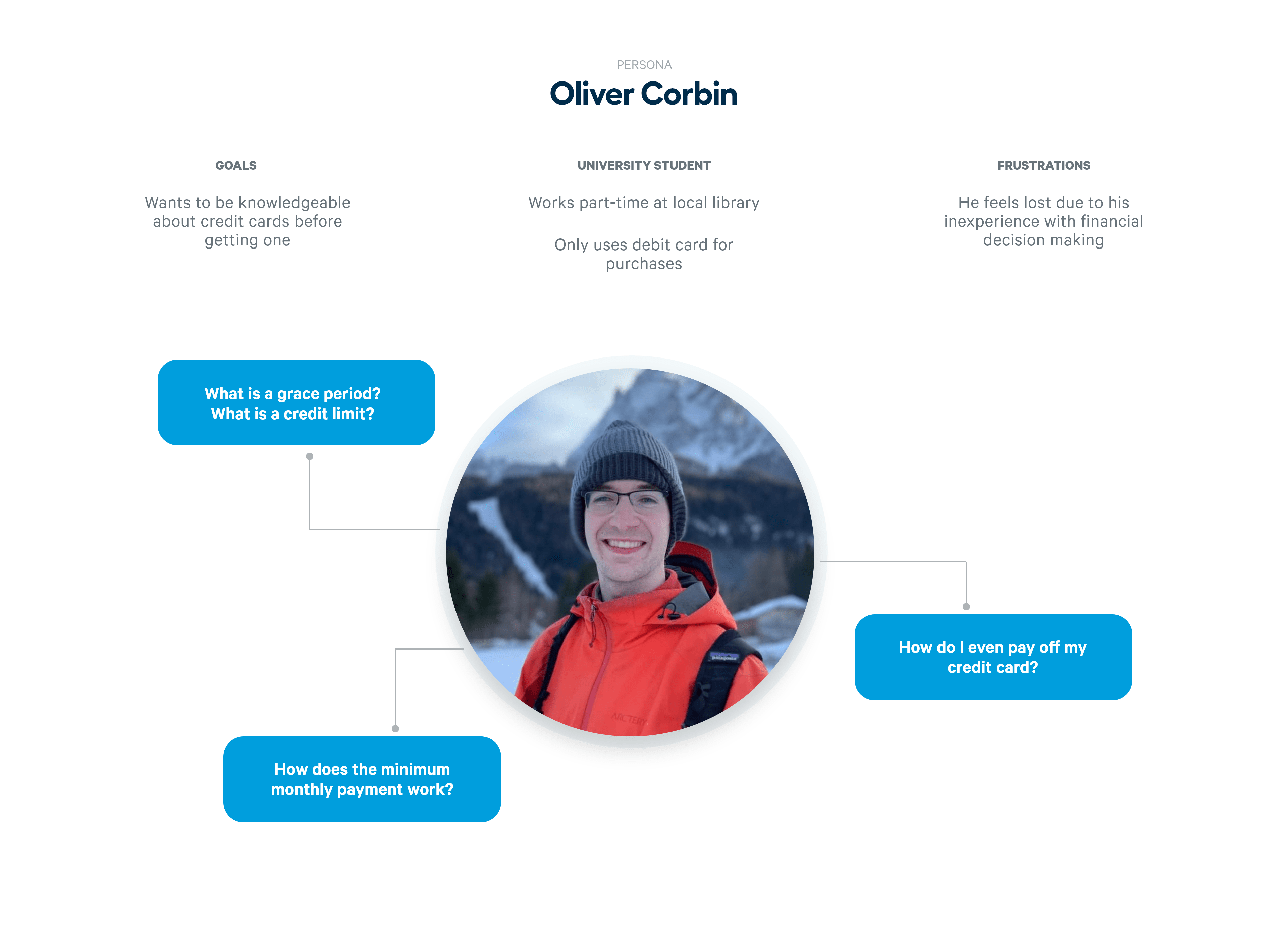

We set out to understand which demographic of banking patrons are the most anxious and what were the key reasons behind this. Two of our key insights highlighted young adults who are inexperienced when it comes to financial decision making. I and two other teammates conducted interviews and observations with individuals that fit our young adult demographic who felt anxious about their finances. With this data, we were able to construct a persona where we highlighted credit card debt and financial literacy as an area of interest.

With this in mind, we reframed our project again into how we might help credit cardholders increase their financial literacy so they may navigate through the credit card debt payment process more easily?

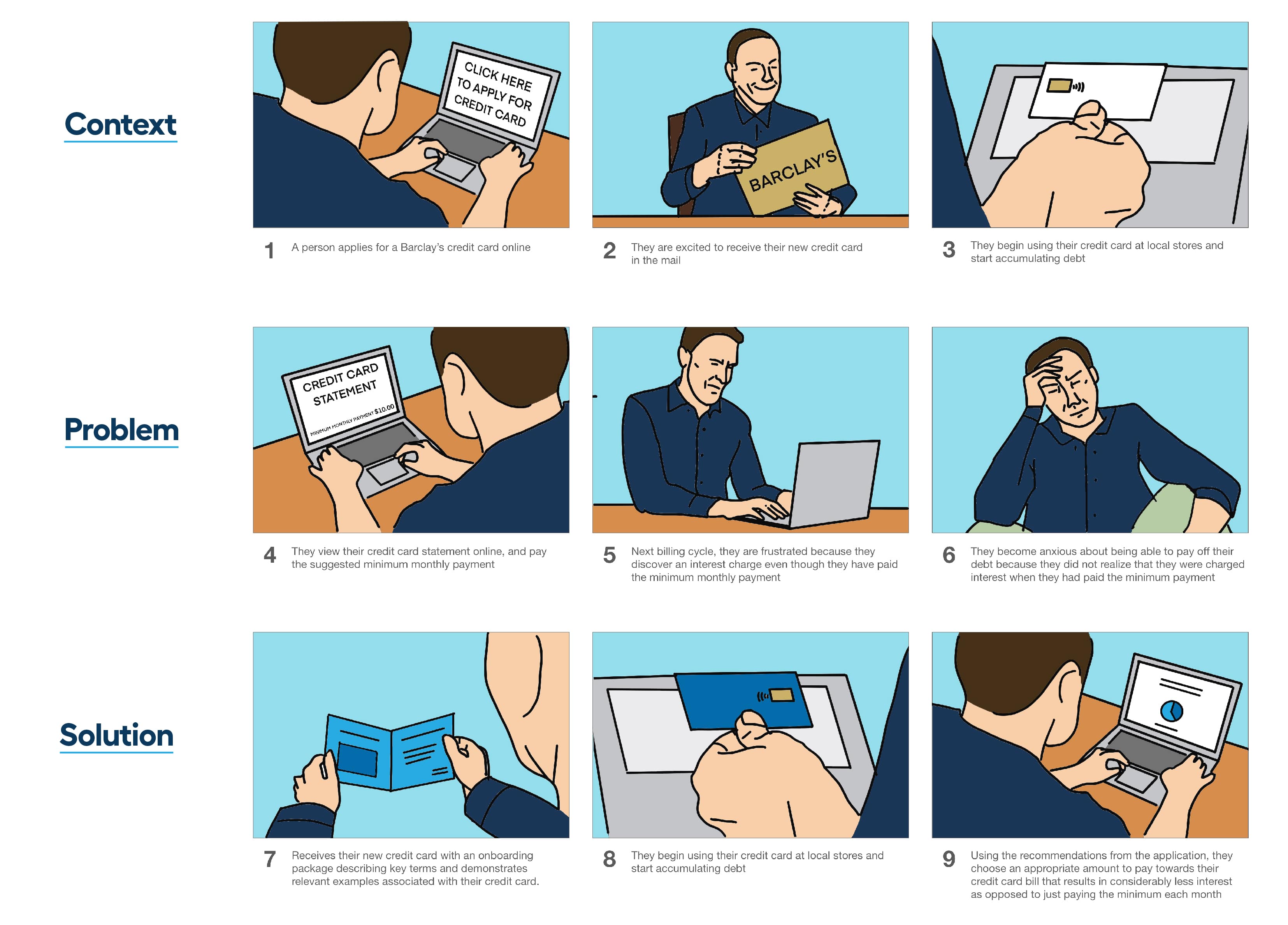

Our interviewees felt that understanding credit cards was challenging for them. They felt that the welcome letter did not explain much, and the financial jargon was difficult to understand. It felt overwhelming as a new credit cardholder.

Our solution is an informative quick start guide that would come in the mail along with the credit card. This package would replace the traditional welcome letter that credit cards usually come with. Our focus is to educate first-time Forward Barclaycard holders about how their credit card works. This is meant to be a proactive measure to deter any future overspending.

I was responsible for the visual design of the physical package trying to keep it aligned with the Barclays brand identity. I also worked with my team on the copy, trying to keep it lay and digestible for novice credit cardholders. The tone was meant to be less intimidating so novices can understand the financial terminology.

I also conducted A/B testing with individuals that fit our persona. We wanted to see which Barclaycard welcome package our participants preferred more, the traditional letter, or our reimagined quickstart package.

Specifically, we looked to see which package participants felt was more informative and gave them confidence in their Barclaycard. Once we went back over the results of the A/B testing, I worked on refining the visuals and tweaking the copy to make it more clear.

One of our main considerations was to make the quickstart guide friendly and inviting. Our interviewees felt that the average banking collateral seemed cold and not welcoming. We wanted customers to feel excited when receiving their new Barclaycard.

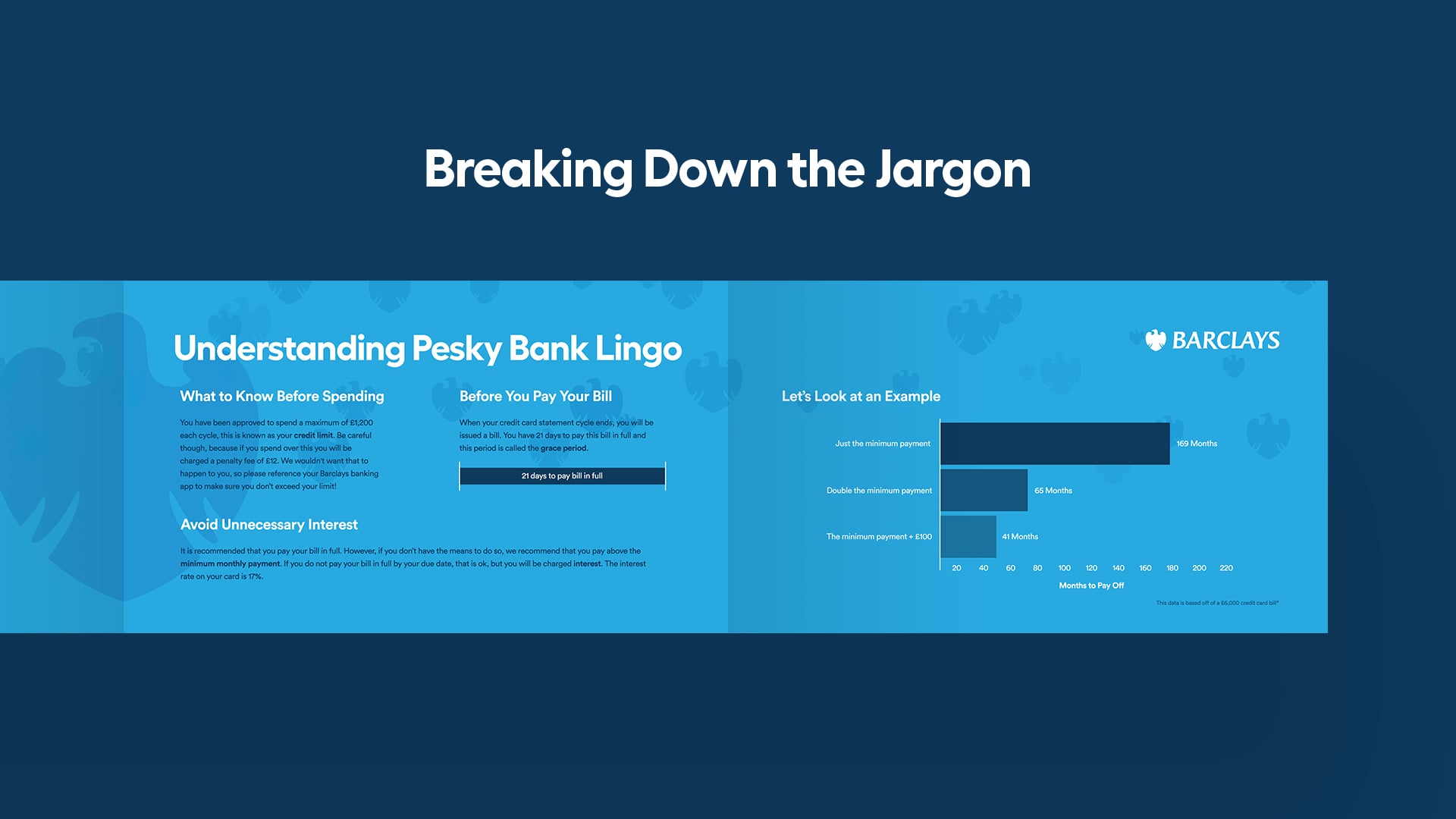

We wanted new Barclaycard customers to understand how the card works before they begin spending. This was to give them confidence and peace of mind to make purchases.

One thing that was a common theme among interviewee's responses was difficulty understanding financial jargon. We tried to break down the most common terms such as credit limit, grace period, and minimum monthly payment.

Catering their product to allow vulnerable customers to succeed is great for public relations. It highlights the company’s values and that they truly care about their customer base.

Customers will feel at more ease after they understand how Barclays products work. This will in turn increase customer confidence and they will want to use Barclays products. Potentially consider the other products and services Barclays offers in personal banking, corporate banking, wealth management, and investment management.

The core ideas of the Barclaycard Quickstart Guide could be scaled for Barclays’ other products such as their higher tiers of credit cards and other offerings in personal banking.

The majority of judges and industry experts felt that the Barclaycard Quickstart Guide was an excellent way to proactively educate first time Barclaycard customers. They also felt that the product had the potential to be scalable. The quick start guide could be tailored for Barclays’ higher cards such as the Barclaycard Platinum.

The redesign of the Barclaycard welcome experience was received with positive feedback from our A/B test participants.

86% of participants felt more knowledgeable about their Barclaycard after having looked at the Barclaycard Quickstart Guide.

71% of the participants appreciated the friendly tone of the Barclaycard Quickstart Guide.

Conducting numerous interviews, facilitating multiple A/B tests, and returning to our research often proved difficult, considering the limited time and resources of a 4-week project. However, this dedication to developing a deep understanding of our challenge, our audience's needs, and our possible opportunities allowed us to keep the door open during discovery to identify subtleties, which pivoted our project from our initial trajectory.

I think it would be interesting to consider how the Barclaycard Quickstart Guide would connect with the digital products that Barclays offers such as their mobile banking app. Looking specifically at how their digital lineup of products could reinforce the ideas we have laid out and continue to create an intuitive experience for customers with anxiety to navigate their finances.

🎉 You made it to the end! Thanks for taking the time to read about this project.

City of Surrey — 5 Min Read

Check out the Process

Fraser Health — 6 Min Read

Check out the Process